Reviewing balance sheets allows you to monitor the financial health of your business by comparing assets, liabilities, and equity over a specific period. Within CoreBridge, balance sheet data provides a snapshot of what your company owns and owes, helping you verify that all reconciliations, payments, and adjustments are reflected accurately. Regularly reviewing this information ensures your accounting records remain balanced and reliable.

Reviewing Past Balance Sheets

Navigate to Accounting Module / Reconciliation.

1. Click Complete Reconciliations tab.

2. Select the Location Name of the completed Reconciliation you want to review.

3. Click Go To Step 2.

4. Review the Income, Expense & Payment Summary information.

a. Income Summary: As orders are moved to completed, the revenue from these sales will be recognized in the appropriate income accounts in this window. Each income category that has recognized revenue along with the amount for that line item will be shown.

b. Expense Summary: Bad Debt payments or changes to In-Store Credit through an added or reduced transaction will be shown in the expense summary.

c. Payments Received: Cash, Check, EFT or Credit Card payments received are recognized in their respective rows.

If there were an Offsetting Transaction to a previously reconciled payment, it would also be shown here.

d. Refunds: Any refunds that were given, regardless of the type, will be shown on the refunds row.

e. In-Store Credit: Any payments made toward invoices using available In-Store Credit.

5. Review the Balance Sheet Information for Assets.

a. Undeposited Funds: This row only shows the change in capital for this reconciliation period and not the current value. The change represents how the balance of your bank account will move, considering payments received and refunds given.

NOTE: Undeposited funds current will be zero because CoreBridge does not track your bank balance.

b. Accounts Receivables: Represents the money your customers owe you.

c. Orders in WIP: Represents the total for orders with a WIP order status, not including sales tax.

d. Orders in Built: Represents the total for orders with a BUILT order status, not including sales tax.

5. Review the Balance Sheet Information for Liabilities.

e. In-Store Credit: Represents the amount of credit that your customers have with your company.

f. Deposits: Represents the amount of payments made toward new orders that have not yet been completed.

g. Orders Not Complete: Represents the total of orders with a WIP or BUILT status, not including sales tax, that the company has committed to produce.

h. Sales Tax: This row only shows the change for this reconciliation period and not the current value. This change in your sales tax liability considers completed or voided completed orders during the reconciliation period.

Note: The values in the Current columns reflect the total Assets and Liabilities as of the date and time of this reconciliation. The values in the Change columns break down how the Assets and Liabilities have changed since your last reconciliation.

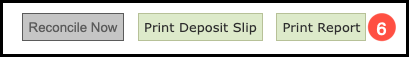

6. To print the balance sheets, click Print Report.