Overview

This article will guide you through the process of setting up QuickBooks Desktop and CoreBridge to prepare for a data sync.

- If you have not Gone Live! with CoreBridge you can still perform these setup steps, however, the actual sync will not occur until you are Live and the sync requirements have been met.

- If you are entering orders or payments in a program other than CoreBridge, we recommend not entering that data again in CoreBridge. Entering it again in CoreBridge may give you duplicate data in QuickBooks.

- If you are entering payments in a program other than CoreBridge, we recommend keeping those bank deposits separate from your CoreBridge deposits.

- If your CoreBridge system has more than one Location, data from all locations will sync to the same QuickBooks company file. There is no way to send each CoreBridge location's data to separate companies unless you use the manual IIF import.

- The sync and the reconciliation are 2 distinct processes. Reconciliations should be performed once your system is Live. The sync will happen after that.

- The sync is one-direction only, from CoreBridge to QuickBooks.

- Once you've gone through your 1st Sync, you should not edit/update/modify/delete any records that sync from CoreBridge to QuickBooks. QuickBooks effectively becomes "look but don't touch" for any records that have synced from CoreBridge.

Sales Tax

- The sales tax report in QuickBooks will not work with Summary Sync.

- It doesn't work because the report doesn't pull sales numbers from journal entries.

- The CoreBridge sales tax reports will need to be used when preparing sales tax forms.

Table of Contents

- Sync Requirements

- Related Articles

- E-Commerce Integration Requirements

- Step 1 – Perform a CoreBridge Reconciliation

- Step 2 - Configure QuickBooks Preferences

- Step 3 – Match Income & Cost of Goods Sold Accounts

- Step 4 – Select an Accounting Export Option in CoreBridge

- Step 5 – Choose Sync Options

- Step 6 – Tax Agencies

- Step 7 – Match Reconciliation Accounts

- Step 8 – Download and install the QuickBooks Desktop Sync Tool

Sync Requirements

Before a sync can happen the following requirements must be met.

- QuickBooks Desktop for Windows 2014 or newer. LINK: Accounting Export Options

- The Summary Sync export method is being used.

- QuickBooks Desktop is installed on a local computer. The software required for the sync will be installed on the same computer that QuickBooks is installed on. The sync software running on a hosted server is not supported. Your QuickBooks company file does not have to be on the same computer that QuickBooks is installed on.

- Your system must be live.

- One or more Completed orders.

- One or more payments.

- One or more Reconciliations that contain payments.

- One or more Reconciliations that contain income.

Related Articles

Please take a few minutes to review these articles. They provide helpful details about the sync.

3rd Party Integration Requirement

Certain 3rd party services that integrate with CoreBridge require special settings to be enabled. Those services are listed here. If a service is integrated with your CoreBridge system please pay special attention to the instructions in the noted instruction step. If a required setting is not enabled, the sales tax that posts to QuickBooks may be erroneous or the journal entry containing sales tax may fail to sync.

- Pressero: Lump Tax Agencies option must be selected (Step 5)

- XMPie: Lump Tax Agencies option must be selected (Step 5)

- TaxJar: Lump Tax Agencies option must be selected (Step 5)

- Avalara: Lump Tax Agencies option must be selected (Step 5)

STEP 1 – Perform a CoreBridge Reconciliation

Is this step optional or required? Required

If your system is live and you have already been performing daily reconciliations, please review READ ME then proceed to Step 2.

READ ME

Each Reconciliation contains the data that will be used to create the QuickBooks journal entry. Without Reconciliations there will be no data to export. The data will sync to QuickBooks as a journal entry and will contain income, payments, and other financial data needed to manage your books. For each Reconciliation in CoreBridge, there will be a corresponding Journal Entry in QuickBooks.

A Reconciliation should be performed at the end of each business day to capture that day's data and to catch any payment entry errors. If wrong payment amounts are captured on the Reconciliation the wrong amounts will sync to QuickBooks.

Performing Reconciliations daily produces the following results:

- Payment entry errors are caught the same day they happen so that they can be corrected in a timely manner, especially errors that are in the customer's favor.

- Credit card payments are captured for the day which is how your merchant likely batches them for a deposit. When you deposit the day's credit card payments in QuickBooks they will match the merchant deposit on your bank statement. The only difference will be any merchant fees. You want as many matches as you can get to your bank statement so that a monthly bank reconciliation is easier to perform.

- You get a clean break between months in QuickBooks when you compare income between QuickBooks and CoreBridge.

INSTRUCTIONS

Please refer to these articles for instructions:

STEP 2 – Configure QuickBooks Preferences

Is this step optional or required? Required

INSTRUCTIONS

Follow the steps in this article to properly configure QuickBooks: QB Desktop - Application Settings for Sync

STEP 3 – Match Income & Cost of Goods Sold Accounts

READ ME

The only accounts needed for the sync are the accounts in CoreBridge. Be sure not to add your entire Chart of Accounts to CoreBridge.

If there is an account in CoreBridge that does not exist in QuickBooks, it will be created automatically in QuickBooks during your 1st sync so there is no need to add it manually. The new account in QuickBooks will be created exactly as displayed in CoreBridge (account number, account name, account type. hierarchy). If you want to have an account created automatically, any parent account noted in CoreBridge will need to either be created by the sync or must already exist in QuickBooks. If you prefer to add an account manually to QuickBooks, be sure it matches exactly to CoreBridge.

ACCOUNT NAMING AND STRUCTURE

- Special characters may cause sync errors. Some examples are $, &, and quote symbols. Please use only letters and numbers for account names. If a special character causes a sync error, the account name will need to be changed in both CoreBridge and QuickBooks for the sync to be successful.

- The name "Shipping" should not be used as an account name. Names like "Shipping Income" or "Shipping Expense" can be used instead.

- Accounts can have 3 levels.

- Parent > Child > Child

- If your existing Income and COGS accounts that will be used in CoreBridge have more than 3 levels please adjust them accordingly in QuickBooks before matching them to CoreBridge.

- Each account must have a unique account number and a unique name. Numbers and names cannot be the same among Income accounts, COGS accounts, and Reconciliation accounts. If you want the sync to create an account for you in QuickBooks during the 1st sync, be sure that an account doesn't already exist in QuickBooks with the number or name of the account that will be created.

INSTRUCTIONS

DUPLICATE ACCOUNTS

- One CoreBridge Account: 4000 Banner Income

- Two QuickBooks Accounts: 4000 Banner Income, 4500 Banner Income

- You will need to change 4500 so that is has a unique name

ACCOUNT MATCHING

- Match Income and COGS accounts between CoreBridge and QuickBooks.

- Account number, account name, account type, and account hierarchy must match exactly.

INCOME ACCOUNTS

- The QuickBooks account type needs to be "Income". Using type "Other Income" will create sync errors causing data to not export.

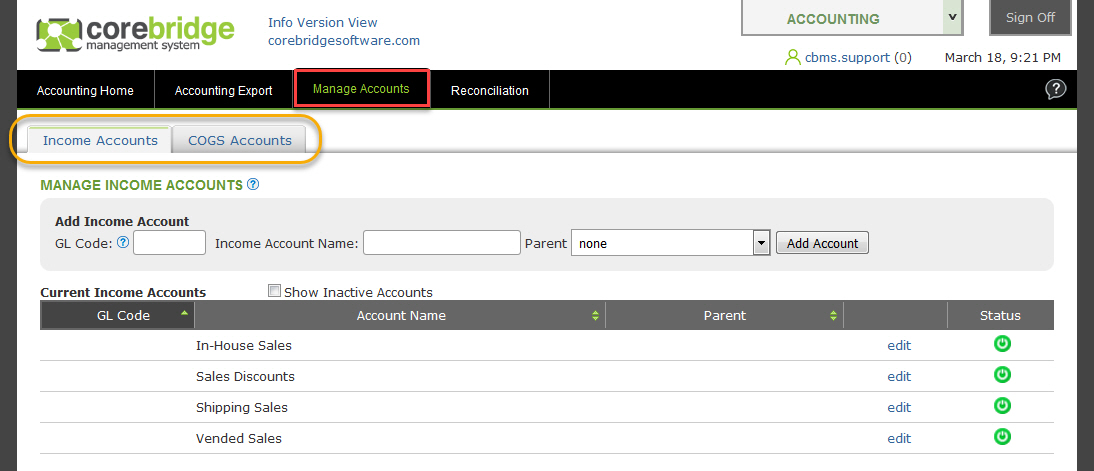

- In CoreBridge, navigate to Accounting Module > Manage Accounts > Income Accounts tab.

COGS ACCOUNTS

- The QuickBooks account type needs to be "Cost of Goods Sold". Using type "Expense" will create sync errors causing data to not export.

- In CoreBridge, navigate to Accounting Module > Manage Accounts > COGS Accounts tab.

- Costs from CoreBridge do not sync but the accounts themselves will sync only if:

- Your subscription includes the Purchasing Module AND

- You choose the option to sync purchase orders

WORKING WITH ACCOUNTS

- The column headings can be used to sort accounts. If the accounts have account numbers, try clicking GL Code once or twice to put the accounts in number order. If the accounts don't have numbers, sorting by Account Name may make the matching process easier.

- Once sorted, start with the first account in CoreBridge. Compare it to QuickBooks. If the CoreBridge account matches exactly to QuickBooks move on to the next account in CoreBridge. (You don't want to start with the first account in QuickBooks because all of your accounts in QuickBooks don't need to be in CoreBridge)

- If the CoreBridge account represents an account in QuickBooks but it doesn't match exactly, change the account in either QuickBooks or CoreBridge to get them to match.

- If you are a Franchisee, CoreBridge is populated with the Franchisor master Chart of Accounts so any change may need to be made in QuickBooks.

- The goal is to get the account to match perfectly between CoreBridge and QuickBooks.

- If a CoreBridge account needs to be changed, click edit, make any needed changes, then click save before moving to the next account.

- If the account being matched is a child account in QuickBooks be sure to select the parent account in CoreBridge so that the account hierarchy matches. If a parent account does not exist in CoreBridge it must be created.

- To create a new account use this section of the page:

- If you are a Franchisee, your accounts may be locked preventing new accounts from being created.

- If you are a Franchisee, your accounts may be locked preventing new accounts from being created.

STEP 4 – Select an Accounting Export Option in CoreBridge

Is this step optional or required? Required only if a support agent has not already saved the setting for you.

If an agent has already saved the setting for you, skip this step and proceed to Step 5.

IF YOU HAVE ALREADY SYNCED

If you have already synced with a different accounting application than QuickBooks Desktop or with a different export method, stop here and contact CoreBridge support. Changing this option after data has been synced will create erroneous data in QuickBooks if a sync is performed with the new setting.

INSTRUCTIONS

If you have been in contact with a support agent this step will probably have been done for you.

- In CoreBridge, navigate to Accounting Module > Accounting Export.

- Select the following options:

- Select Export Type: Sync with Desktop Application

- Application Name: QuickBooks

- Sync Type: Lump Data Sync

- Lump Sync and Summary Sync are the same things.

- Click the Save button. A warning dialogue may appear. Since you have never synced you can safely click OK.

STEP 5 – Choose Sync Options

Is this step optional or required? Required

INSTRUCTIONS

In CoreBridge, navigate to Accounting Module > Accounting Export > Account Setup tab.

5-A. Lump Tax Agencies

If any of these integrations are being used now or will be used in the future, Lump Tax Agencies must be selected:

- Pressero

- XmPie

- TaxJar

- Avalara

How the option works:

- If the option is selected:

- Sales Tax will post to a single account regardless of the number of Tax Agencies in CoreBridge.

- We recommend selecting this option if all sales tax is paid to a single taxing authority.

- Sales Tax will post to a single account regardless of the number of Tax Agencies in CoreBridge.

- If the option is not selected:

- A unique G/L account can be matched to each Tax Agency.

- Each time a new Tax Agency is added to CoreBridge you will need to click Sync Tax Agencies then match the new agency to an account in QuickBooks. (See step titled "Match Reconciliation Accounts")

- We recommend not selecting this option if sales tax is paid to various taxing authorities and you want each to have its own account in QuickBooks.

5-B. Ignore non-completed orders

- WIP (Asset)

- Built (Asset)

- Orders Not Complete (Liability)

Do you want to see WIP and BUILT values in QuickBooks?

- If No, select this option

- If Yes, do not select this option

This option is a one-time choice before your 1st sync. If you want WIP and BUILT values in QuickBooks you need to have starting balances. Un-selecting the option after your 1st sync will not provide QuickBooks with the values from prior Reconciliations which are needed for the account balance to match between CoreBridge and QuickBooks.

STEP 6 – Tax Agencies

Is this step optional or required? Required if the Lump Tax Agencies option was not enabled in Step 5-A.

If the Lump Tax Agencies option was enabled, skip this step and proceed to Step 7.

INSTRUCTIONS

- In CoreBridge, navigate to Accounting Module > Accounting Export > Account Setup tab.

- Click the Sync Tax Agencies button and wait for the web page to refresh.

- This pulls in all Tax Agencies from the Management Module with rates higher than 0%.

- If no Tax Agencies exist or they all have a 0% rate nothing will happen.

- Tax Agencies with rates need to be pulled into this window so that they can be matched to a G/L account.

STEP 7 – Match Reconciliation Accounts

Is this step optional or required? Required

A-1. Sales Tax Liability vendor assignment: NON-US countries only

If your version of QuickBooks Desktop is US please skip this and proceed to B. INSTRUCTIONS.

- For the purpose of this article, we use the term "sales tax" to represent the accrued liability owed to a taxing entity. Various countries have their own unique term. For example:

- VAT, GST, HST, QST, SST, ICMS, Commercial Tax, Consumption Tax, Revenue Tax, Turnover Tax

- VAT, GST, HST, QST, SST, ICMS, Commercial Tax, Consumption Tax, Revenue Tax, Turnover Tax

- For many non-US countries, QuickBooks Desktop supports assigning a Sales Tax Agency Vendor on journal entries. This is not a supported sync feature, however, a Sales Tax Agency Vendor may be assigned manually to the appropriate G/L liability account once the journal entry has synced.

A-2. Sales Tax Liability G/L account: NON-US countries only

If your version of QuickBooks Desktop is US please skip this and proceed to B. INSTRUCTIONS.

- Before matching a CoreBridge sales tax liability account to a General Ledger account in QuickBooks, confirm that the Other Current Liability account in QuickBooks is not associated with any Sales Tax Agency vendor.

- If an G/L account is associated with a Sales Tax Agency vendor, QuickBooks will require additional fields to be used on the journal entry for the liability account. These additional fields are not supported by the sync and the sync will fail. The typical required fields that are not supported are NAME and TAX ITEM. Specific required fields and names may vary by country.

- If a G/L account is associated with a Sales Tax Agency vendor, QuickBooks will set the account as a System account.

- If a tax liability account in QuickBooks is a System account, the account should not be matched to CoreBridge. If a System account is matched, the journal entry will fail to sync since the additional fields required by QuickBooks are not supported.

To determine if a tax liability account is a QuickBooks System account: - In QuickBooks, edit the account

- Look at Account Type

- If the drop-down is grayed out where Account Type cannot be changed, the account is a System account

- If all of the sales tax liability accounts in your Chart of Accounts are associated with a Sales Tax Agency vendor, please create a new G/L account or accounts to match to CoreBridge that will never be associated with a Sales Tax Agency vendor at the vendor level.

(Screenshot from QuickBooks showing liability accounts assigned on a Sales Tax Agency vendor)

- If you un-assign the tax liability account on all Sales Tax Agency vendors in order to use the account to match to CoreBridge, please be sure to reach out to your accountant or to QuickBooks support for guidance before doing so. Un-assigning an account may not be reversible.

- If you un-assign the tax liability account on all Sales Tax Agency vendors in order to use the account to match to CoreBridge, please be sure to reach out to your accountant or to QuickBooks support for guidance before doing so. Un-assigning an account may not be reversible.

B. INSTRUCTIONS

- In CoreBridge, navigate to Accounting Module > Accounting Export > Account Setup tab.

- The collection of accounts displayed here are referred to as Reconciliation Accounts. These accounts need to be matched to QuickBooks just like Income accounts.

- My CoreBridge Accounts

The section titled "My CoreBridge Accounts" contains the internal names for the accounts along with the account type. The account type noted needs to match the account type in QuickBooks. This section is for reference only to show what Account Type to use when matching accounts to QuickBooks.

Don't use this section to match accounts to QuickBooks. The section to match to QuickBooks is named My Accounting Software Accounts.

Since CoreBridge exports to various accounting applications, the Account Type name is used generically. Please refer to the Cross-Reference table which shows the actual name of the Account Type in QuickBooks.

- Cross-Reference TableACCOUNT TYPE CROSS-REFERENCEIN COREBRIDGEIN QUICKBOOKSExpenseExpense (not Other Expense)Accounts ReceivableAccounts ReceivableLiabilityOther Current LiabilityTaxOther Current Liability

- My Accounting Software Accounts

This is the section of the page where you will match CoreBridge to QuickBooks.

The account numbers shown in the screenshot are completely random. Use of the numbers shown is not required.

- Reconciliation Account matching

Accounts need to match between CoreBridge and QuickBooks for the sync to be successful. Account number, account name, account type, and account hierarchy have to match exactly.

If there is an account in CoreBridge that does not exist in QuickBooks, it will be created automatically in QuickBooks during your 1st sync so there is no need to add it manually. The new account in QuickBooks will be created exactly as displayed in CoreBridge (account number, account name, account type, hierarchy). If you want to have an account created automatically, any parent account noted in CoreBridge with a colon will need to exist in QuickBooks. if you prefer to add an account manually to QuickBooks, be sure it matches exactly to CoreBridge. - Account Naming and Structure

Special characters may cause sync errors. Some examples are $, &, and quote symbols. Please use only letters and numbers for account names. If a special character causes a sync error, the account name will need to be changed in both CoreBridge and QuickBooks for the sync to be successful.

Accounts can have 3 levels.

Parent:Child:Child

If your existing accounts that will be used in CoreBridge have more than 3 levels please adjust them accordingly in QuickBooks before matching them to CoreBridge.

Each account must have a unique account number and a unique name. Numbers and names cannot be the same among Income accounts, COGS accounts, and Reconciliation accounts.

- The collection of accounts displayed here are referred to as Reconciliation Accounts. These accounts need to be matched to QuickBooks just like Income accounts.

- Match each account in CoreBridge to an account in QuickBooks.

- The accounts listed under "My Accounting Software Accounts" must be matched to QuickBooks.

- Account number, account name, account type, and hierarchy must match.

- Compare each account to QuickBooks.

- If the CoreBridge account represents an account in QuickBooks but it doesn't match exactly, change the account in either QuickBooks or CoreBridge to get them to match.

- If a CoreBridge account needs to be changed, click edit, make any needed changes, then click save.

- If the account being matched is a child account be sure to follow the directions on the page to properly match the account hierarchy. The parent/child hierarchy for Reconciliation accounts follow the QuickBooks method of using a colon to delineate parent and child accounts. For example, Bad Debts as a child of Expenses.

- Expenses:Bad Debts

- Expenses:Bad Debts

- Undeposited Funds account

- When matching the Undeposited Funds account between CoreBridge and QuickBooks, the account in QuickBooks must be the built-in system account designated by QuickBooks.

- If the account is not the system account, you will not be able to record deposits in QuickBooks.

- How to tell if it's the system account when in QuickBooks:

- Edit the account.

- If the Account Type is grayed out, it's the system account.

- If the Account Type is not grayed out, it's not the system account.

- How to tell if it's the system account by using the Chart of Accounts IIF export:

- The column titled EXTRA will read "UNDEPOSIT"

- The column titled EXTRA will read "UNDEPOSIT"

- OPTIONAL – If you want to keep your CoreBridge accounts separate from existing accounts you can create new accounts. This can be helpful if you are in the process of closing out a previous POS system and don't want to commingle numbers in a single account.

Examples:- CB A/R (instead of Accounts Receivable)

- CB Deposits (instead of Deposits)

- CB Bad Debt

- CB Sales Tax Payable

For a detailed explanation of these CoreBridge Reconciliation accounts, please review the following support article: Reconciliation Account Details

STEP 8 – Download and install the QuickBooks Desktop Sync Tool

Is this step optional or required? Required

INSTRUCTIONS

The software must be installed on the same computer that QuickBooks is installed on.

If Windows does not have the required component installed that the software will need, you will be prompted to download and install it from a Microsoft website. This may require a computer restart.

Follow the steps in this article to download and install the software required for the sync: QB Desktop - Sync Tool Installation

NOTE: Once the software has been downloaded and installed the settings do not need to be configured. The settings will be configured during your 1st Sync web meeting.