Overview

- Helps you catch incorrect payment entries so they can be fixed.

- Captures data that can sync/export to your accounting software.

This article covers the following topics:

- Reconciliation details

- How to Perform a Reconciliation

Table of Contents

Reconciliation details

- General Information

- Reconciliations and Lump Sync

- Reconciliations and Full Sync

- Viewing Payment Details

How to Perform a Reconciliation

- 1. Gather Source Documents

- 2. Start the Reconciliation Process

- 3. Review and Verify Payments and Refunds

- 4. Review In-Store Credit, Bad Debt, and Voided Order Transactions

- 5. Finish the Reconciliation

- 6. Save the Reconciliation

Other

General Information

- Performing a daily CoreBridge Reconciliation is critical to the accounting sync/export.

- If your CoreBridge system is "Live!" (entering real orders and payments), a CoreBridge Reconciliation should be performed at the end of each business day.

- Reconciliations should be performed while you are waiting for your 1st sync/export. There is no need to wait until the sync/export happens.

- If your CoreBridge system has multiple locations, a Reconciliation should be performed daily for each location.

- Users can keep working in the system while a Reconciliation is being performed. Any transactions that happen during the process will be captured on the next reconciliation.

- The date and time of the current Reconciliation will be set when the Reconcile Accounts button has been clicked. The date cannot be changed. A different date cannot be selected.

- Each Reconciliation contains all financial activity in CoreBridge that happened between the Reconciliation start date and end date:

Start Date = Previous Reconciliation Date

End Date = This Reconciliation Date

- Financial activity includes: Income / Bad Debt expense / In-Store Credit / Payments / Accounts Receivable / Deposit liability / Sales Tax

Reconciliations and Summary Sync

- The values that are captured on each Reconciliation are the values that will sync/export to your accounting application. Without Reconciliations no data will sync/export.

- On Page 2 (step 2) of each Reconciliation are the summary values that will post to the Journal Entry in your accounting application.

- Each Reconciliation in CoreBridge will create a Journal Entry in your accounting application.

- If a location is open 6 days per week you will have 20-25 Reconciliations in CoreBridge per month for that location which will give you 20-25 Journal Entries in your accounting application.

Dates

- When viewing the list of completed Reconciliations, the Date column shows the date of each Reconciliation.

- The Reconciliation date is the same as This Reconciliation Date.

- The Reconciliation date from CoreBridge will be the Journal Entry date in your accounting application.

Income Summary

- There will be one line on the journal entry for each income account captured on the Reconciliation.

Expense Summary

- There will be a line on the journal entry for each of these expenses captured on the Reconciliation. If there was no activity there would be no lines on the journal entry.

- Bed Debt payment

- In-Store Credit that was manually added to the customer account

Balance Sheet Information

- On Page 2 in the Balance Sheet Information section, the values that sync/export are the Change amounts. The amount is what changed between the Reconciliation start date and end date.

- A positive amount increases the value of the account in your accounting application

- A negative amount decreases the value of the account in your accounting application

- For Example, A/R went down by $100.00 which will reduce the A/R account balance in your accounting application by $100.00.

Payments

- Payments post to the Undeposited Funds account in your accounting application.

- Deposits must be manually recorded in your accounting application so that the CoreBridge payments that sync/export show up in the appropriate bank account.

- Each payment type, except Credit Cards, will be an individual line on the journal entry so that each payment type can be deposited as needed.

- Payments post as summary amounts only. Individual payments do not sync/export.

For example:

- The journal entry line for checks will have a value of $500.00. There won't be 5 individual lines for each of the 5 checks.

Payments - Credit Cards

- Visa and MasterCard payments are added together and will be an individual line on the journal entry.

- Discover and American Express will each be individual lines on the journal entry.

For Example:

- There will be 3 lines on the journal entry.

- $750.00 - Visa plus MasterCard

- $350.00 - Discover

- $160.00 - American Express

- Before manually recording deposits, be sure to determine how your merchant deposits your Discover and American Express payments. Some merchants deposit those together with Visa/MC and others deposit them separately. You want to know because you want your manually recorded deposits to match the deposits that will appear on your bank statement.

- Before manually recording deposits, you will also want to know if your merchant takes out their fees per deposit. If merchant fees are deducted from each deposit we recommend recording the fees when the deposit is recorded so the deposit in your accounting application matches to your bank statement.

Reconciliations and Full Sync

- The payments that are captured on each Reconciliation will sync to your accounting application. Without reconciliations, no payments will sync.

- In QuickBooks, payments post to the Undeposited Funds account. Deposits must be manually recorded so that the payments that sync show up in the appropriate bank account.

- All payments sync individually.

- Each payment, besides refunds and NSFs, will be recorded with the same transaction number from CoreBridge: CB-XXX

- Refunds and NSFs will have unique numbers in your accounting application that differ from the transaction number in CoreBridge.

- Refunds post directly to the bank account configured (A) on the sync tool for QuickBooks desktop sync or (B) in CoreBridge for QuickBooks Online and Xero.

Viewing Payment Details

During the reconciliation process and in completed reconciliations, individual payments can be viewed.

To view individual payments, click the link showing the number of payments.

# Transactions – The quantity of orders paid. A single payment may pay more than one order.

(screenshot showing result when clicking "5" in the Checks section)

How to Perform a Reconciliation

1. Gather Source Documents

- Source documents are what you will use to calculate the actual amounts that were paid by customers. These are the amounts that are being reconciled against what was entered in CoreBridge.

PAYMENT TYPE SOURCE DOCUMENT Cash Cash and receipts for cash purchases (from a cash drawer, box, till, etc) Checks Checks EFT 1. Report from the financial institution where EFT payments are processed.

2. e-mail or text noticeCredit Card Report from your credit card processor. Could be from a terminal or online merchant website. Other Report from the source where Other payments are generated Refunds Could be any of the above

2. Start the Reconciliation Process

A. Navigate to Accounting Module > Reconciliation

B. Click the Reconcile Accounts button. The Reconciliation window will open.

C. If your system has multiple locations, select the location you want to Reconcile using the Select Location drop-down. If your system has only one location it will automatically populate.

- For systems with multiple locations, each location should be Reconciled daily.

D. All financial information since the last reconciliation is retrieved for the specific location.

- Previous Reconciliation Date: This is the date and time of the previous Reconciliation for the specific location.

3. Review and Verify Payments and Refunds

INSTRUCTIONS

- Working through each section, calculate the total of each payment type using source documents.

- Enter the total in the Actual Counted box.

Actual Counted should match Amount / Calculated Total.

Amount / Calculated Total is the system-calculated total of payments entered.

If the amounts don't match, the discrepancy will show in Difference. The Reconciliation cannot be saved if there is a difference.

If there is a difference, close the Reconciliation, identify and fix the discrepancy, then start the Reconciliation again.

Cash

The Cash section not only helps in Reconciling your cash payments for the day but it also helps you balance your petty cash (cash drawer). If you are syncing/exporting, the cash total should be the same in three places after your sync/export and after making deposits in your accounting software:

- Cash Drawer

- Ending Cash on the most recent reconciliation

- The Petty Cash account in your accounting software

The on-screen help guides can be found by hovering your mouse over the blue question marks.

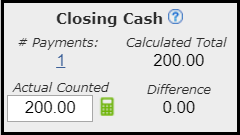

A. Closing Cash

- Count the amount of cash on hand, plus any paid out amounts. Cash paid out will typically reflect the value of receipts from cash purchases.

- Actual Counted should be what you have in your cash drawer plus whatever cash was paid out.

- Calculated Total is Starting Cash plus payments entered.

B. Cash Adjustments

- Cash In: Enter an amount here when adding cash to your cash drawer that is not coming from customer cash payments. You may be funding your cash drawer when opening a new store so that you have change for customers. Amounts entered will increase Ending Cash in CoreBridge only. Amounts entered in this field will not sync/export to your accounting software.

- Cash Out (Paid Out): Enter an amount here when using cash from your cash drawer. This will typically reflect the value of receipts from cash purchases. Amounts entered will decrease Ending Cash in CoreBridge.

- Cash Out (To Deposit): Enter the amount of cash that will be deposited. Amounts entered will decrease Ending Cash in CoreBridge and sync/export to your accounting software. It will show in QuickBooks as Cash (Deposit), this should be deposited to the bank account.

Note: If the petty cash account in your accounting software doesn't match CoreBridge, you should balance the account with your cash drawer then use Cash In and Cash Out to get CoreBridge to match since those amounts don't sync/export.

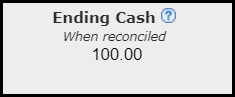

C. Ending Cash

- This section doesn't require an entry. It is a calculation of results from A and B.

- The Ending Cash amount should match what will be left in the cash drawer after the reconciliation is saved.

D. Cash Adjustments - how they affect your accounting application when you sync/export

- Cash In: This amount will not sync/export. If the amount needs to be recorded in your accounting application it will need to be recorded manually.

- Cash Out (Paid Out): This amount will not sync/export.

- Cash Out (To Deposit): This amount will sync/export.

E. Cash with Lump Sync

- Cash Out (To Deposit): The memo in your accounting software will be "Cash Out (Deposit)" and the amount should always be posted to a bank account.

- When you receive cash payments and a portion will remain in your cash drawer, the memo in your accounting software will be "Cash (Other)" and the amount should always be posted to a petty cash account.

- To summarize, when recording cash deposits:

- "Cash Out (Deposit)" should always be deposited to a bank account

- "Cash (Other)" should always be deposited to a petty cash account

Checks

A payment type of Check should represent an actual physical check that can be brought to the bank. Even if you use remote check deposit by scanning or taking a picture of a check, the payment type should still be "Check" since you were given an actual check.

- Total all checks

- Enter the value in Actual Counted: Total $

- If difference = 0 there is nothing else to do.

- If there is a difference, close the reconciliation, fix the problem, then start a new reconciliation.

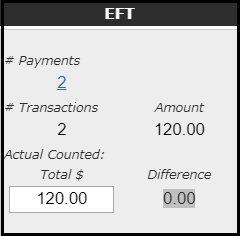

EFT

- Determine the total of all EFT payments from source documents.

- Enter the value in Actual Counted: Total $

- If difference = 0 there is nothing else to do.

- If there is a difference, close the reconciliation, fix the problem, then start a new reconciliation.

Credit Cards

A payment type of Credit Card should represent a payment processed through a credit card processor.

- Determine the total of all credit card payments from source documents.

- Enter the value in Actual Counted: Total $

- If difference = 0 there is nothing else to do.

- If there is a difference, close the reconciliation, fix the problem, then start a new reconciliation.

Other

A payment type of Other should represent a payment that doesn't fit the other categories. (e.g. clearinghouse, barter)

- Determine the total of Other payments from source documents.

- Enter the value in Actual Counted: Total $

- If difference = 0 there is nothing else to do.

- If there is a difference, close the reconciliation, fix the problem, then start a new reconciliation.

Refunds

A Refund can be any payment type.

- Click the link under # Payments

- A new window will appear showing the refunds entered by users.

- Review each refund to determine if it is valid.

- If there is a refund that is not valid, close the reconciliation, fix the problem, then start a new reconciliation.

- If all refunds are valid, close the transaction window then enter the value from Amount in Actual Counted: Total $

4. Review In-Store Credit, Bad Debt, and Voided Order Transactions

These three sections don't require an entry. They are for review only.

In-Store Credit

This section displays In-Store Credit activity.

- Manual addition of credit

- Manual reduction of credit

- Refunds to in-store credit

- Refunds from prior credit given

Bad Debt

This section displays Bad Debt payment activity.

Voided Orders

This section displays orders that have been voided.

- If you need to open a voided order that must be done outside of the Reconciliation window.

5. Finish the Reconciliation

If any discrepancies remain they will be noted in Red and you will not be able to proceed to Step 2.

Page 2

Page 2 page shows the financial activity that will be captured on the Reconciliation:

- Income, Expenses, Payments, Accounts Receivable, Sales Tax and Balance Sheet activity

Income Summary

- Income is recognized when an order is completed or when a completed order is voided.

- In these instances revenue will be recognized in the appropriate income accounts. Each income account that has revenue will be shown along with the amount.

- If you click the Income Summary link the details window will open.

Expense Summary

- Bad Debt: the total of Bad Debts payments

- In-Store Credit: Total of manual additions or reductions of in-store credit.

Payments Received

- The total amount of payments entered is displayed for each payment type.

- Cash, Check, EFT, Credit Cards, Other and Refunds reflect the amounts that affect your bank account.

- Refunds, regardless of payment type, will be shown on the refunds row.

- In-Store Credit shows payments made toward invoices using available In-Store Credit. This amount should not affect your bank account.

Balance Sheet Information

The balance sheet section provides a snapshot of your Asset and Liability values. There are two columns:

- Change: The change in value between Previous Reconciliation Date and This Reconciliation Date.

- Current: The current value as of This Reconciliation Date

Assets

- Undeposited Funds: The value that will reflect in your bank account. The value matches SubTotal in the Payments Received section.

- Accounts Receivables: The amount your customers owe you.

- Orders in WIP: The total of orders with a WIP order status, not including sales tax.

- Order in Built: The total of orders with a BUILT order status, not including sales tax.

Liabilities

- In-Store Credit: The amount of credit that your customers have with your company.

- Deposits: The amount of payments made toward an order that has not yet been completed. When an order is completed the liability is reduced.

- Orders Not Complete: The total of orders with a WIP or BUILT status, not including sales tax, that the company has committed to produce.

- Sales Tax: The change for this reconciliation period. Generated when an order is completed or when a completed order is voided.

6. Save the Reconciliation

Once a Reconciliation has been saved it cannot be edited.

All payments that were reconciled are locked and can no longer be edited. If a payment needs to be fixed after it has been reconciled, you will need to issue refunds or additional payments to get CoreBridge to match the actual payment. Those transactions will be part of the next reconciliation and should balance out the original erroneous payment.

- Enter any notes in the Reconciliation Notes box that you want to have saved along with the reconciliation.

- Click the Reconcile Now button.

You get a final warning before saving!

If any payments need to be edited this is your last chance. Click "X" to close the confirmation window to return to the Reconciliation.

Click Yes to save the Reconciliation.

Once saved, the Reconciliation cannot be edited and all reconciled payments can no longer be edited.The Reconciliation will be assigned a sequential number and will display in the historical Reconciliation list. You may need to refresh the web page to see the newly saved Reconciliation.

Print Reports

Once a Reconciliation has been saved, the Reconciliation reports can be printed.

Deposit Slip

The deposit slip lists (1) the amount of cash entered in Cash Out (To Deposit) and (2) each individual check that was entered.

- The location address from the Management Module is displayed.

- If you use the CoreBridge deposit slip to make a deposit, be sure to write the account number. CoreBridge does not store bank account numbers.

Reconciliation Report

The report displays the following information:

- Summary values from Page 2

- Cash breakdown

- Individual payment details