Tax Groups combine multiple Tax Agencies - such as local, county, and state - into a single group that applies a unified tax rate for a specific area. Setting up Tax Groups ensures that sales tax is accurately calculated and applied to your Customers and Orders, allowing your system to manage taxes seamlessly and in compliance with local requirements.

Note: Before you can create Tax Groups, you must create Tax Agencies to add to the group. For more information, please see Creating Tax Agencies.

How to Add a Tax Group

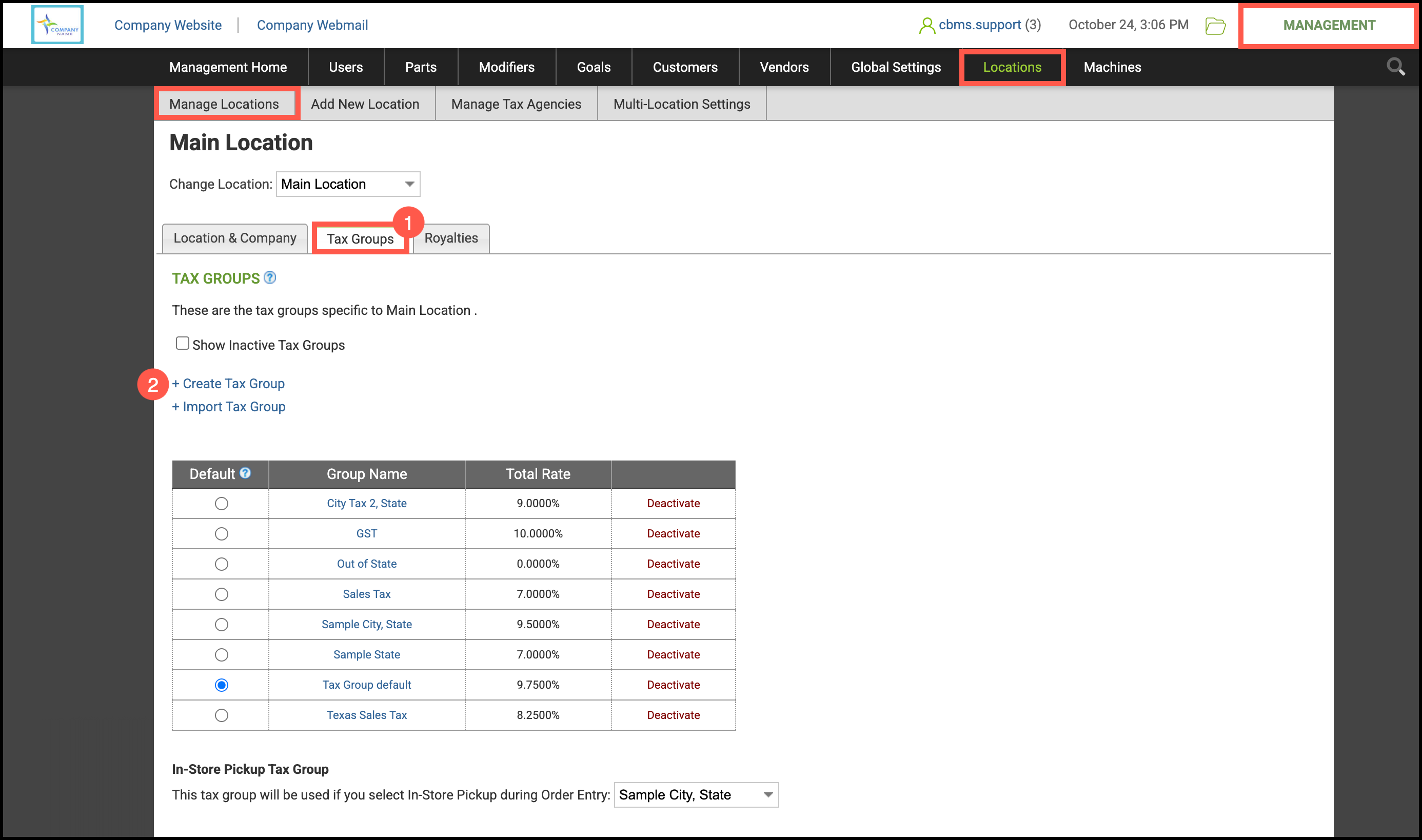

After creating your Tax Groups, you can set one as the default, which will automatically apply to all newly created Customers and Walk-In transactions. To make changes, click the Tax Group name and update the necessary details.

By default, the Tax Group assigned to a Customer Location will be used during Estimate and Order Entry, though it can be adjusted as needed during those processes.

Navigate to the Management Module / Locations / Manage Locations and select the appropriate Location.

1. Click on the Tax Groups tab.

Note: You can switch between locations by using the drop-down menu above.

2. Click Create Tax Group.

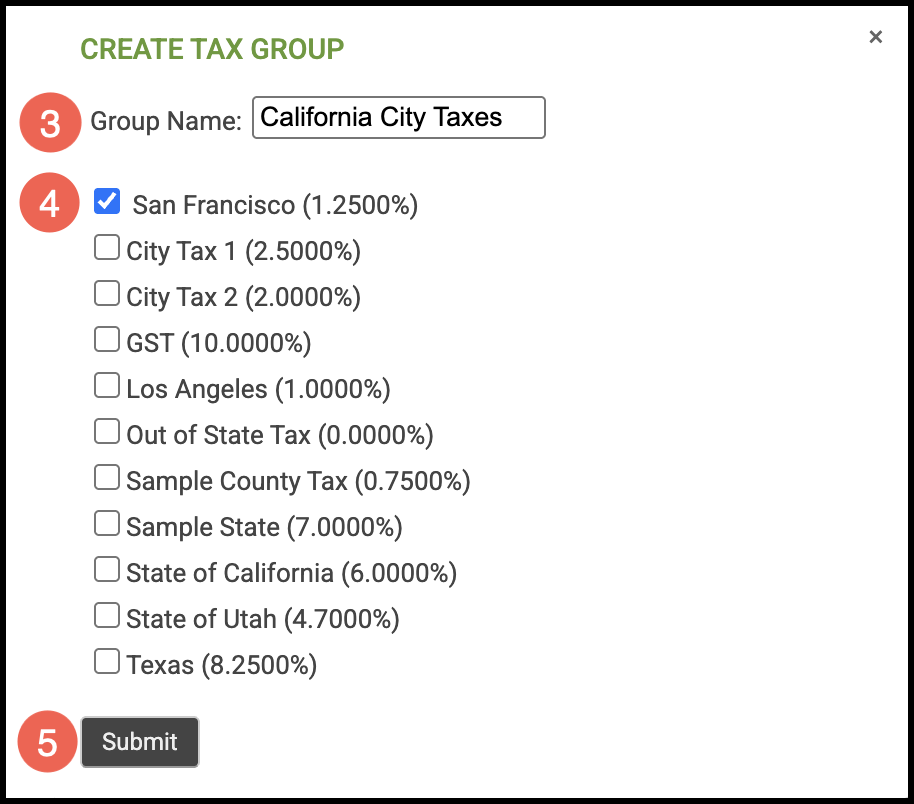

3. Enter a descriptive Tax Group Name that helps you identify which Tax Agencies are in the group.

Note: Tax Group names and Tax Agency names must be different.

4.Select the Tax Agencies that apply.

5.Click Submit.